The Road to Starting a Successful Business: Navigating Wholesale Licensing

Starting a business is a thrilling adventure, filled with opportunities but also laden with obstacles. Among the foundational steps to kick-start a wholesale or retail-centric business is securing a wholesale license. This legal document not only validates your business but also introduces a myriad of perks such as tax exemptions, access to bulk purchasing, and elevated profit margins. In this extensive guide, we explore the journey to obtaining a wholesale license, delving into its costs, requirements, and benefits. Whether you're a seasoned business figure or stepping into the entrepreneurial world, this guide sets you up for a smooth navigation through the process.

Understanding the Wholesale License

A wholesale license is a crucial legal credential that enables businesses to procure products in bulk directly from manufacturers or distributors without incurring sales tax. This is essential for businesses looking to resell these products to other retailers or end consumers. Without such a permit, businesses must pay sales tax on each transaction, significantly hiking up costs and compressing profit margins.

The Role of Wholesalers

Wholesalers serve as pivotal links between manufacturers and retailers. By purchasing goods in bulk at reduced prices, wholesalers can resell them at higher rates, thus boosting their profit margins. Depending on your location, a wholesale license may also be known as a reseller permit, reseller license, or seller’s permit.

The Imperative Need for a Wholesale License

A wholesale license brings several key advantages to the table, including:

- Tax Exemptions on Bulk Purchases: A principal benefit of a wholesale license is sidestepping sales tax on bulk purchases. This saves businesses from cumulative sales tax on each transaction, allowing for tax-free bulk procurement.

- Access to Preferential Pricing: Wholesale licenses provide businesses access to significantly reduced wholesale prices, enhancing margins when products are resold.

- Legitimacy and Trust: Possessing a wholesale license enhances business credibility and fosters trust, paving the way for favorable negotiations and partnerships.

- Adherence to Legal Requirements: Compliance with state-specific taxation and licensing regulations is crucial, solving legal predicaments that might arise without a proper license.

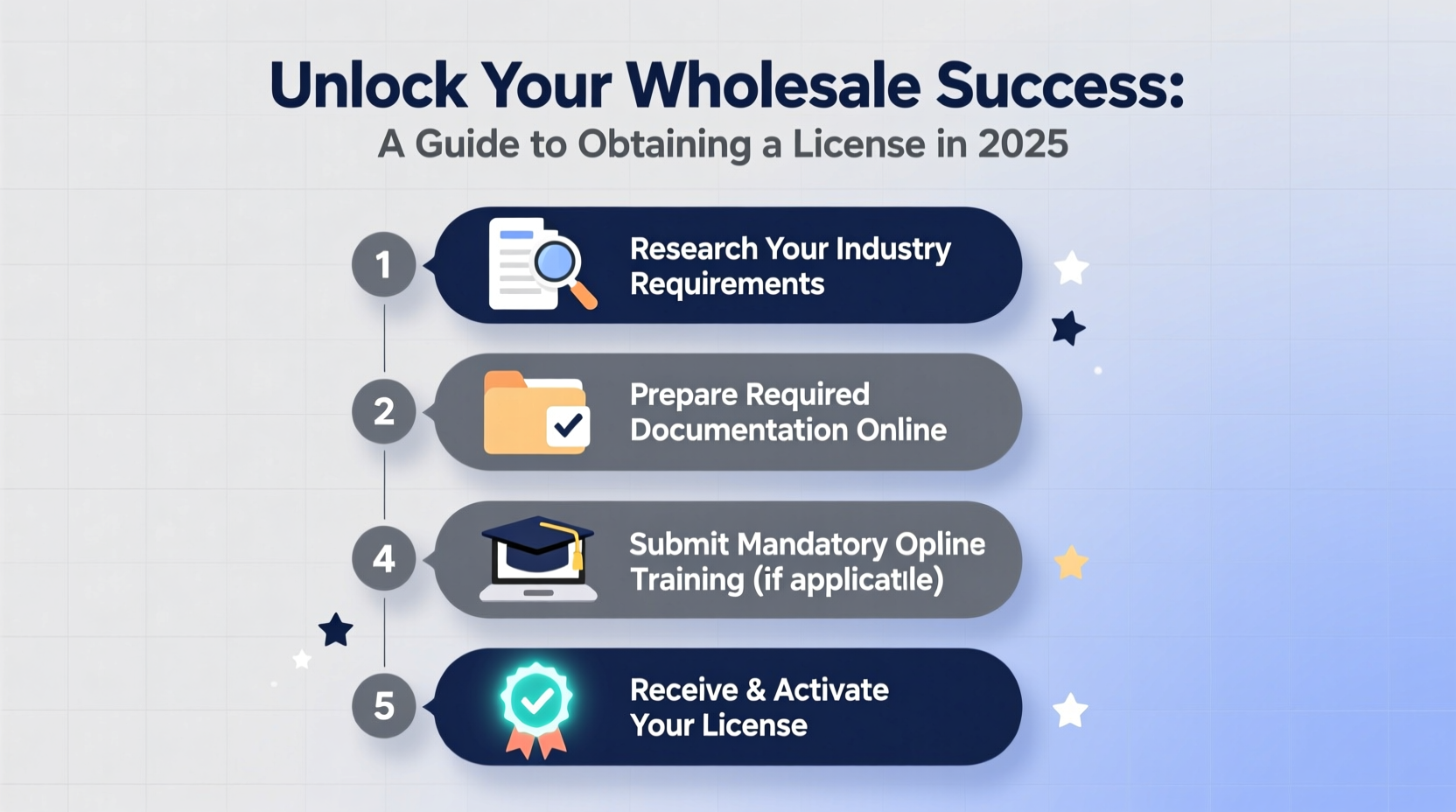

Securing a Wholesale License in Five Steps

Step 1: Business Registration

Kickstarted by registering your business as an independent legal entity. Select a distinctive business name, address, and structure—be it a sole proprietorship, partnership, LLC, or corporation. This vital step not only legitimizes operations but simplifies obtaining necessary permits, reinforcing perceived business reliability.

Step 2: Acquire an Employer Identification Number (EIN)

After registration, apply for an EIN from the IRS—essentially the social security number of your business—to monitor fiscal activities like taxes and payroll. Applications are free and readily accessible online.

Step 3: Sales Tax Permit Procurement

The sales tax permit authorizes sales tax collection on products sold, with state-specific obtaining processes. This permit is imperative to avoid potential fines or legal consequences.

Step 4: Document Preparation

Gather requisite documents which often include business name and legal structure, EIN, sales tax permit, local government-issued business license, and your business' physical address. Clear descriptions of your business offerings complete the document set.

Step 5: Wholesale License Application

With preparatory documentation ready, proceed to submit your wholesale license application—either online or in-person, contingent upon local requirements. The associated fee varies by state and industry, and approval timelines differ.

Frequently Asked Questions

| Question | Answer |

|---|---|

| Can I buy wholesale with a seller’s permit? | A seller’s permit often serves as a wholesale license; verify with your state’s tax office for proper business licensing. |

| How long does it take to get a wholesale license? | Timing varies per state, from days to weeks based on local processes. |

| Do I need an individual license for each state? | Yes, multiple state operations demand specific state licensing adherence. |

| Can I sell wholesale without a license? | No, wholesaling sans a license is illicit and invites penalties and legal exposure. |

Conclusion: Your Pathway to Wholesale Success

Securing a wholesale license is foundational in building and scaling your business. Besides enabling discounted pricing, it offers tax perks and boosts profit margins. Methodically adhering to outlined steps will facilitate a successful license acquisition, propelling your business forward. Remember to research local regulations thoroughly and ensure all essential documents are accounted for. With dedication and strategic planning, you’re on the track to thriving as a wholesaler.

For more in-depth business insights and global supplier connections, visit Accio.com and link up with top-tier international suppliers.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4